The Problem with Importing Settlement At Once

If you're an ecommerce seller, chances are you want an accurate view of your books per month or per year. For tax purposes, you care about your income and expenses for the fiscal year or calendar year, ending squarely on Sept 30 and Dec 31 respectively. Or if you're accounting per quarter, you need your books calculated correctly on the last day of each quarter: Q1-March 31, Q2-June 30, Q3-Sept 30, Q4-Dec 31.

However, ecommerce marketplaces don't always pay out perfectly on the end of the month. For example, Amazon collects your sales and expenses for a two-week period and pays you out at the end of that settlement period. This period could start on Dec 20 and end on Jan 3, for example.

For accounting purposes, if you wrote all the sales and expenses from Dec 20 to Jan 3 as accounting transactions on Jan 3, then you've undercounted the data in Dec and overcounted the data in Jan.

Ideally, you want to make sure that sales and expenses that take place in Dec, also get written to your accounting software in Dec. Likewise for Jan, all the sales and expenses that take place in Jan, also get written to your accounting software in Jan.

Group by Day Feature

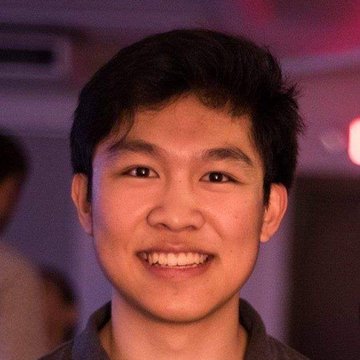

Importing sales and expenses as transactions in your accounting software on the day that they occur solves this problem. Navigate to the settings of your integration to enable this. Klavena will process the data, group by day, and write into QuickBooks per day instead of per settlement.

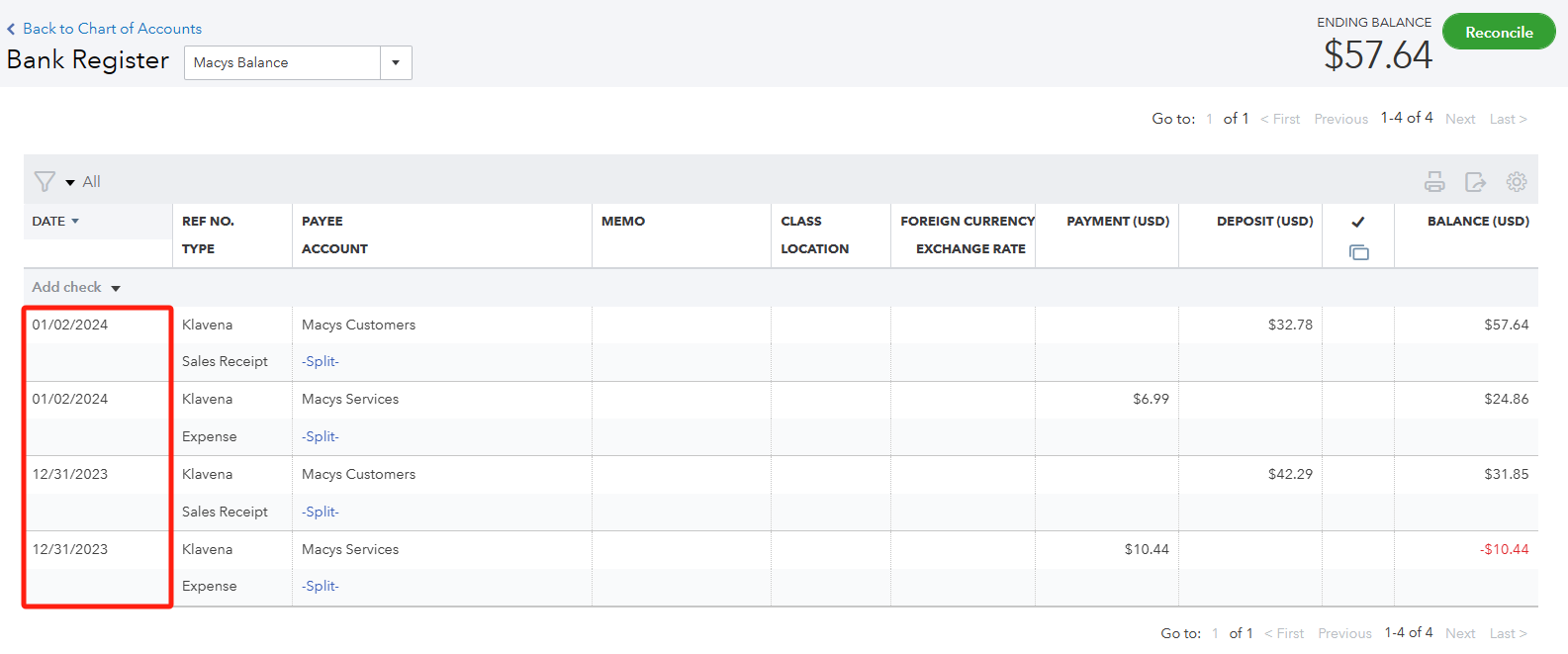

Result: Before

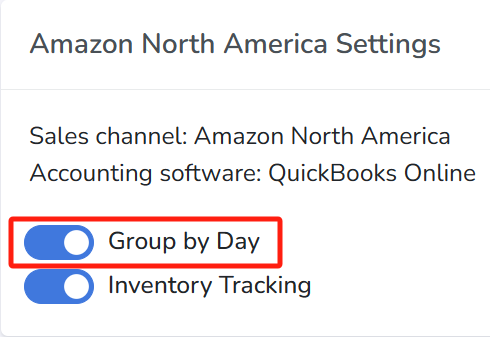

Result: After